E-Vendor Payment Documentation

Grow your business. Get paid from anywhere.

Overview

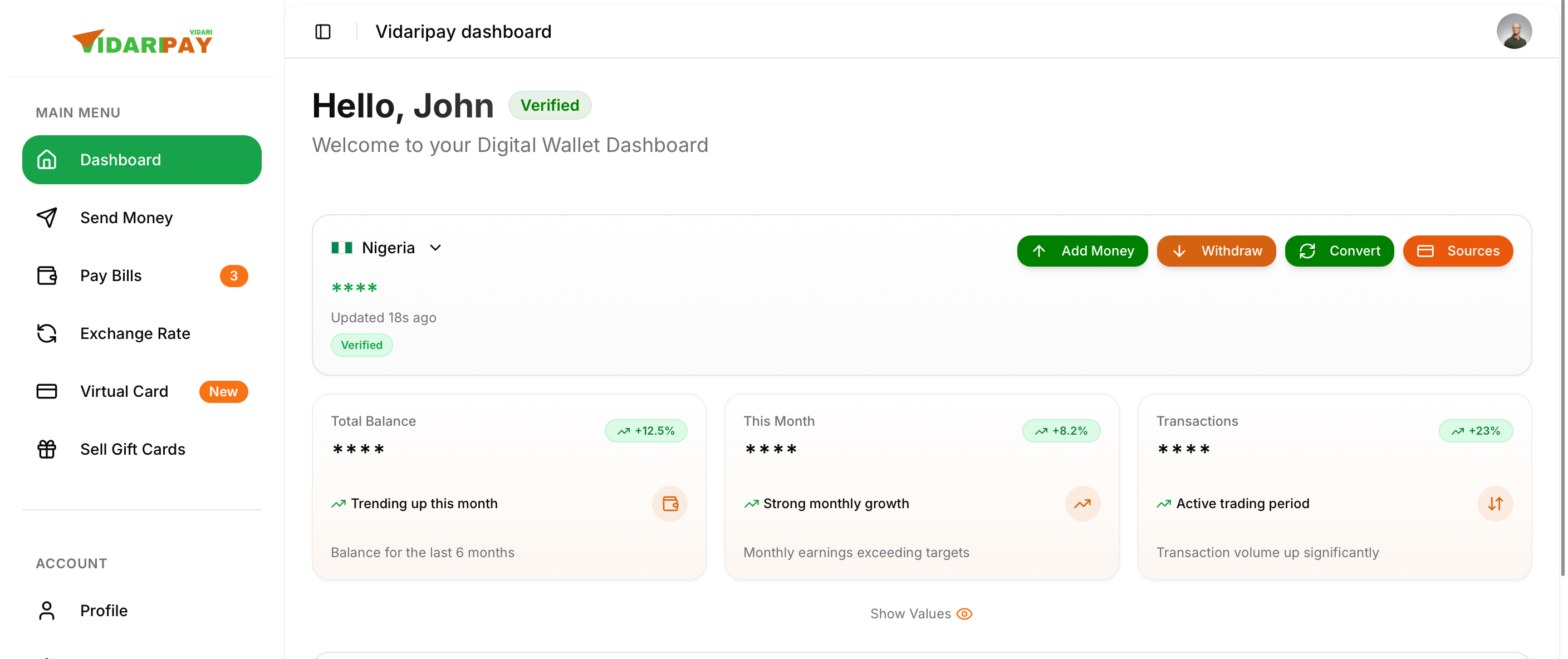

With Vidaripay’s E-Vendor system, you can accept payments from customers in Africa and globally. Payments are received instantly, and withdrawals are made in your local payout currency.

Vidaripay enables E-Vendors to accept secure card payments from customers worldwide, with automatic currency conversion and local payouts based on applicable exchange rates and settlement schedules.

Additional payment methods may be introduced over time, subject to regulatory approval, provider requirements, and regional availability. When new payment options become available, you will be notified through your dashboard and registered email.

Our goal is simple: help African vendors receive payments across borders securely and efficiently.

Key highlights

- Accept payments globally

- Automatic currency conversion

- Local payouts in supported countries

- Secure, compliant payment processing

Card Payments

The Vidaripay E-Vendor Dashboard allows you to accept card payments from customers worldwide. Customers can pay in their local currency, while you receive your earnings in your selected payout currency through automatic currency conversion.

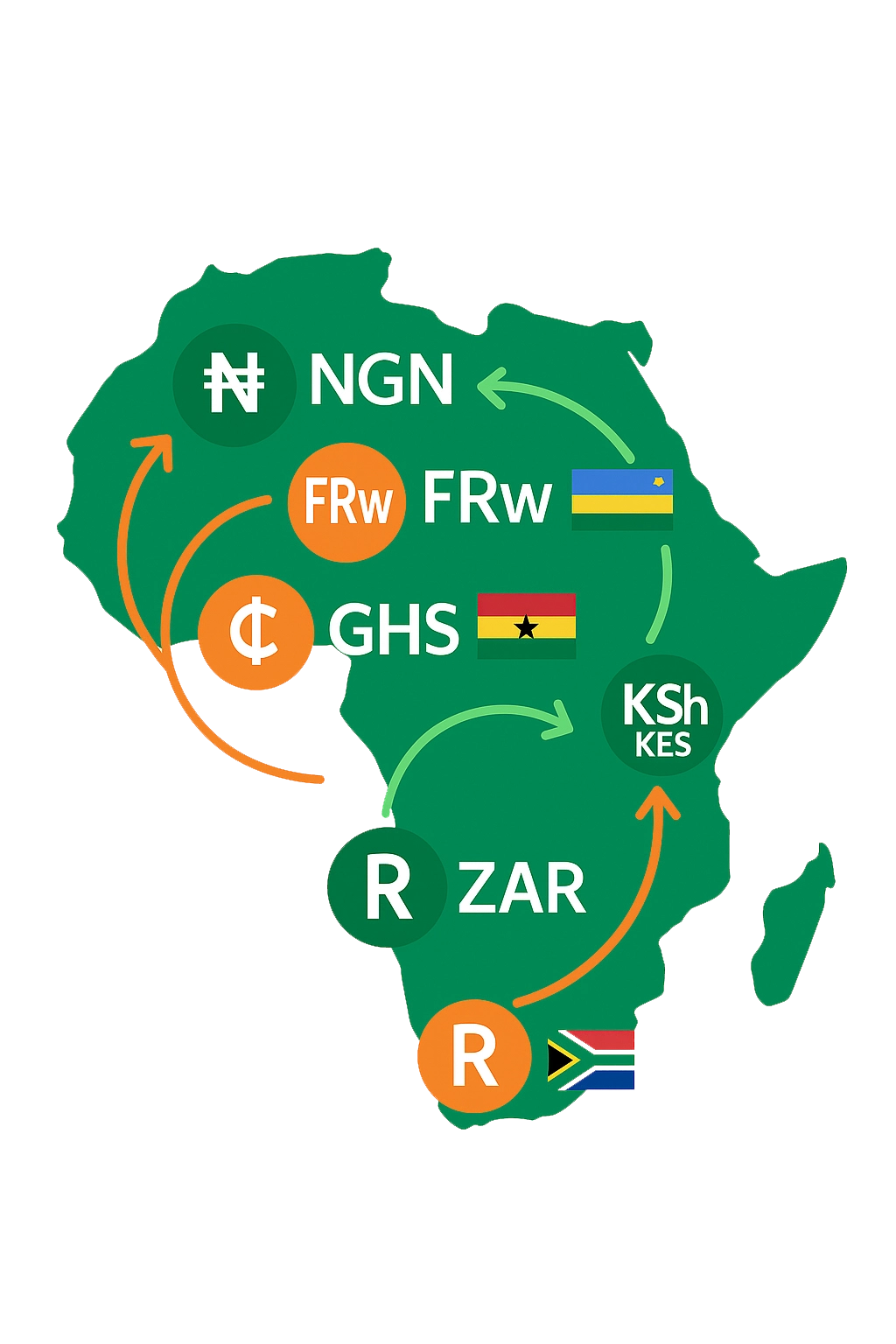

Expanding African Currency Support

We are adding support for more African regions, including:

- GHS (Ghana)

- KES (Kenya)

- XAF / XOF (Cameroon, Senegal, Côte d’Ivoire, etc.)

- GMD (Gambia)

- ZAR (South Africa)

- TND (Tunisia)

All foreign payments appear in your dashboard and are converted to your payout currency during withdrawal.

Who Can Register

You must be:

- A shop owner, freelancer, service provider, or verified agent

- Based in Rwanda, Nigeria, or any supported African country

- Able to provide basic identification and verification documents

Registration Requirements

Rwanda (RWF Vendors)

- National ID or passport

- RDB certificate (if registered)

- RRA license (optional)

- Proof of address

- Selfie holding your ID

- Storefront photo with logo/business name (optional but recommended for fast approval)

- Short description of your business

- Compliance onboarding call (required)

Nigeria (NGN Vendors)

- National ID / NIN / Passport

- CAC certificate

- Proof of address

- Selfie holding your ID

- Storefront photo (optional but recommended for fast approval)

- Short explanation of your business

- Compliance onboarding call (required)

Other African Countries

- Government-issued ID

- Business or agent certificate (if available)

- Proof of address

- Selfie holding your ID

- Storefront photo (optional but recommended for fast approval)

- Purpose of account

- Compliance onboarding call (required)

Some countries may require extra steps depending on local laws.

What You Get

You must be:

- Create payment links

- Track sales instantly

- View customer payments

- Monitor your business growth

- Manage your store details

- Access the Payment Security Center

- Stay fully in control of your operations

…and more tools built to support your business every day

Payment Links

Create a payment link in seconds:

- Enter amount and description.

- Share the link via WhatsApp, SMS, email, or any messaging platform.

- Customers complete payment using available payment methods shown at checkout.

- Payment confirmation appears instantly on your dashboard.

Available payment methods depend on your account status, region, and enabled payment options.

Settlement & Withdrawals

Withdraw your earnings through:

- Mobile Money

- Bank transfer

- Cashout agents (where supported)

Payout Time

We process payouts as quickly as possible. Most vendors receive their money fast, but timing can vary:

- Rwanda (RWF): Often within minutes, up to 24 hours

- Nigeria (NGN): Usually same day, up to 24 hours

- Global payout requests: Depends on destination and payout method

Some transfers may take longer if extra checks are required or if banking networks are slow.

Currency Conversion

Foreign payments are converted to your payout currency at fair and transparent rates.

Notifications

Instant alerts for:

- New payments

- Withdrawal updates

- KYC progress

- Account activity

Chargebacks & Disputes

If a customer disputes a payment:

- You will receive a notification in your dashboard and by email

- You may be asked to provide supporting evidence, such as receipts, messages, or proof of delivery

- The dispute will be reviewed and resolved according to the rules of the payment provider that processed the transaction

Dispute timelines, outcomes, and final decisions are determined by the relevant payment provider.

This process is designed to protect both the vendor and the customer.

Refunds

You can request a refund for your customer anytime.

Refunds are deducted from your Vidaripay balance.

Compliance & Policies

KYC & AML

You must complete KYC before activating deposits, withdrawals, or extra dashboard features.

Prohibited Activities

Vendors are strictly prohibited from using Vidaripay for:

- Fraud

- Gambling

- Money laundering

- Illegal or unauthorized financial services

This helps protect both the vendor and the customer

Security Monitoring

We monitor accounts to keep the platform safe and to protect all vendors.

Security You Can Trust

Vidaripay uses bank level security, encrypted transactions, real-time monitoring, and alerts for anything unusual.

You can also view security updates inside your Security Center on the dashboard

Vendor Responsibilities

To keep your account active:

- Keep your details updated

- Make sure transactions are genuine

- Use payment links only for real business

- Follow alerts about disputes or refunds

- Keep your login secure

- Double-check amounts before sharing links

Regulatory Compliance

We follow:

- RURA & BNR (Rwanda)

- NDPR & CBN (Nigeria)

- Data protection and privacy laws

- Local regulations in supported countries

Vidaripay is a registered Data Controller in both Rwanda and Nigeria, ensuring all personal data is handled with full compliance and accountability

Simple Flow How It Works

- Create a payment link

- Share it with your customer

- Customer pays with their card

- Payment appears instantly

- Withdraw in your local currency

Partner With Us

Fintech aggregators, telcos, banks, and agent networks can partner with Vidaripay.

Contact:

partnerships@vidaripay.comVidaripay Rights

To keep the platform safe and compliant, Vidaripay may:

- Ask for more verification

When extra checks are needed or required by law.

- Review or delay transactions

If something looks unusual or needs compliance review.

- Limit or suspend accounts

If verification is incomplete, suspicious activity appears, or rules are not followed. (You will always be notified.)

- Decline high risk activity

Including fraud, scams, or illegal financial services.

- Update rules or fees

As the platform grows or regulations change.

- Close an account if required

In cases of confirmed fraud, repeated violations, or legal instructions.

This protects all vendors and keeps the platform safe.